In August 2021 the Caribbean Catastrophe Risk Insurance Facility (CCRIF) made its largest single pay-out, $40 million, to Haiti’s government. CCRIF member governments have been steadily increasing their coverage since its launch in 2007. When CCRIF was launched, it provided nearly $500 million of coverage to 16 member countries; now it provides over $1 billion of coverage to 22 member countries and one electric utility.

This reflects the benefits of using both risk pooling and parametric insurance for governments of countries exposed to high catastrophe risk that struggle to get adequate cover in conventional insurance markets.

Pooling risk

CCRIF became the first multi-country risk pool in the world when it was formed in 2007 to offer catastrophe coverage to exposed Caribbean governments. In 2015, CCRIF expanded to provide coverage to Central American governments too.

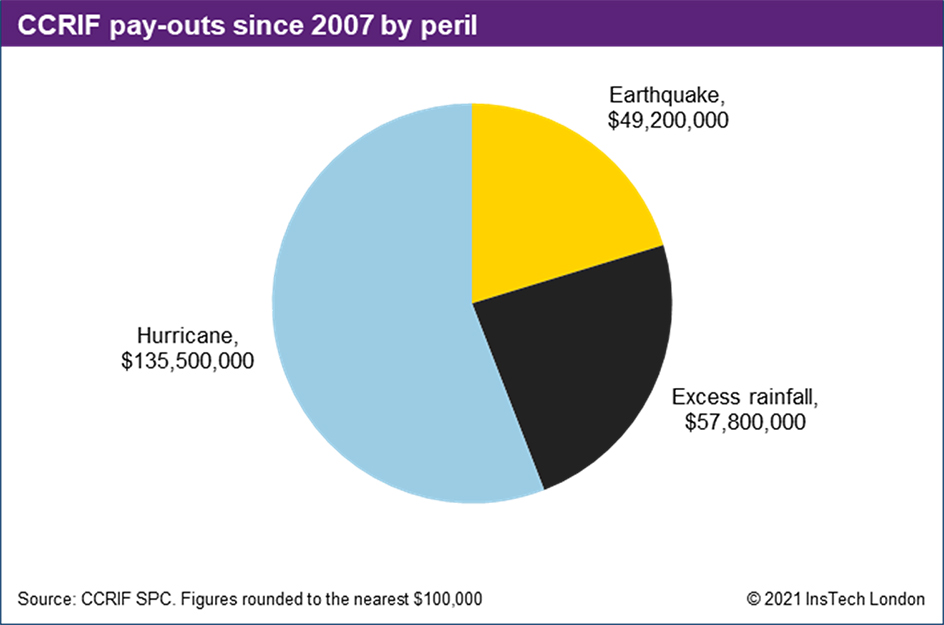

The coverage it offers is parametric insurance, which allows claims to be paid out based on a trigger event rather than a loss. This increases the speed of pay-out after an event, providing governments with short-term liquidity. CCRIF has now paid out 53 claims totalling more than $242.4 million in response to hurricanes, earthquakes and excess rainfall.

This year CCRIF’s policies have been supported by Global Parametrics, which specialises in parametric solutions for emerging markets.

CCRIF’s support for Haiti

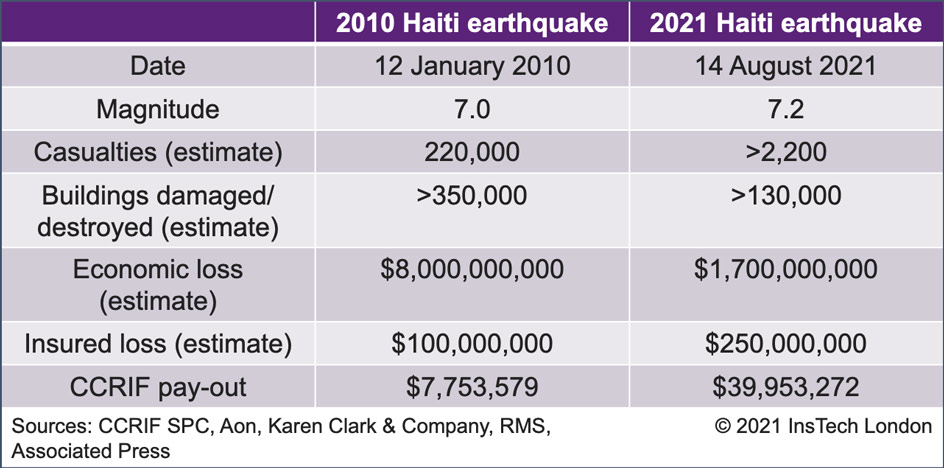

On 14 August 2021, Haiti experienced a magnitude 7.2 earthquake, the natural disaster which has caused the greatest loss of life in 2021 so far. Tropical Depression Grace (which later strengthened to Hurricane Grace) brought torrential rain two days later. The Haitian government has received $39,953,272 from CCRIF in response to the earthquake.

CCRIF guarantees full payment of claims within 14 days of an event. It paid $15 million to Haiti within one week to support recovery efforts. CCRIF provided the remainder of the payment within the 14-day window.

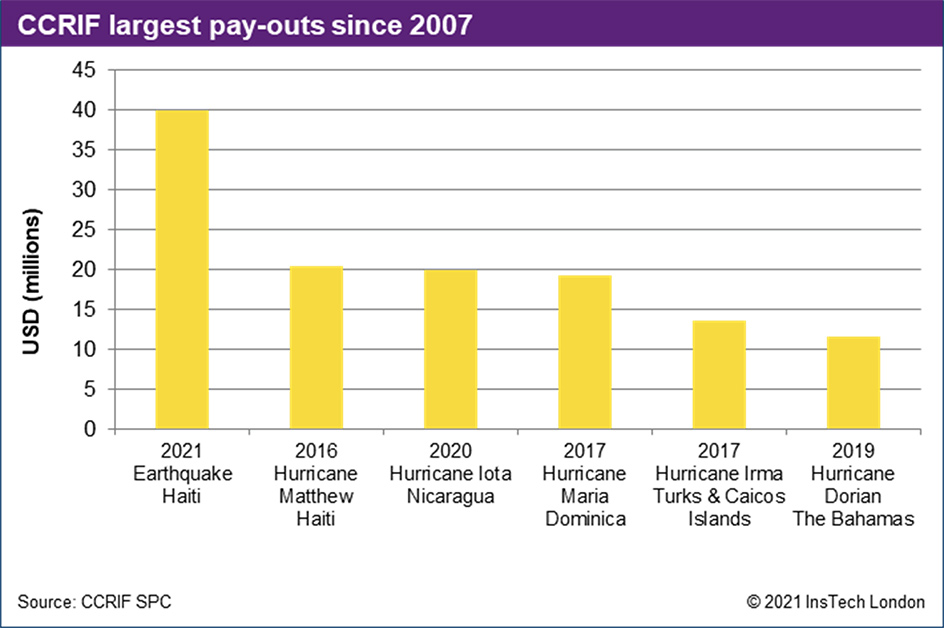

CCRIF’s previous largest pay-out was also to Haiti, following Hurricane Matthew in 2016. CCRIF has made only six pay-outs of over $10 million; the five others were in response to hurricanes.

The $40 million pay-out represents the full coverage limit for Haiti’s earthquake policy. Haiti will continue to have $40 million of earthquake coverage until 31 May 2022 under the policy’s reinstatement of sum insured provision.

Haiti had received four pay-outs from CCRIF prior to the recent earthquake. Over 32% of the money paid out by CCRIF since 2007 has been to Haiti, more than double any other government. CCRIF’s CEO Isaac Anthony said, “We continue to closely monitor the overall situation in Haiti, including the passage of Tropical Cyclone Grace and its potential impact on the country and stand ready to further support our member country in this time of crisis.”

Haiti’s catastrophe resilience struggle

Haiti has low catastrophe resilience due to a mixture of economic and political issues. This has severe consequences for a country which experiences many natural catastrophes. Haiti’s location on a fault zone between two tectonic plates makes it highly exposed to earthquakes. It is also vulnerable to hurricanes, droughts and floods.

Haiti has the lowest GDP per capita, adjusted for purchasing power, in the Americas, with over 50% of its population below the poverty line. According to the executive director of the Haitian National Human Rights Defense Network 60% of the country is controlled by gangs. The assassination of Haiti’s president in July left a political vacuum. Few elected representatives remain after the two-year postponement of elections.

Haiti’s economy and finance minister says the CCRIF pay-out “will help finance rapid and tangible government activities geared towards supporting the poor and vulnerable affected by the earthquake.”

Haiti’s most devastating disaster in recent history was in 2010, when a magnitude 7.0 earthquake struck 25 kilometres from the country’s densely populated capital city, killing 220,000. The picture above shows the damage caused to Haiti’s presidential palace. CCRIF paid out $7.8 million to the government following that event; the difference between that and the more recent pay-out represents the increase in earthquake coverage Haiti has bought from CCRIF in recent years.

CCRIF says its 2010 pay-out was the first financial payment received by the government after the earthquake and was used to pay salaries to rescue and emergency workers, to fund medical assistance, clear debris and provide civilian security.

Parametric insurance supporting economic recovery

Companies offering parametric solutions face the challenge of selling a product not well understood by customers. For larger customers such as governments and corporations, there are plenty of opportunities and resources to educate the customer. With every high-profile CCRIF pay-out, other emerging economies become more aware of how parametric policies can support their resilience to catastrophes. For small businesses and households, educating customers is more challenging.

Personal lines parametric insurance is being used in countries with low catastrophe resilience. The Microinsurance Catastrophe Risk Organisation (MiCRO) facility was founded by companies including Swiss Re and Guy Carpenter subsidiary GC Micro Risk Solutions in the wake of Haiti’s 2010 earthquake. It provides rainfall, hurricane and earthquake parametric microinsurance products targeted at low-income populations in Central America and the Caribbean.

Super.mx started offering parametric earthquake policies to homeowners, renters and businesses in Mexico City in 2020 and launched nationwide in June 2021. Insurance penetration is low in Mexico, only 2.6% compared to the global average of 7.3%, and 40% of Super.mx’s clients have never purchased property insurance before.

Every week there is more news about parametric insurance policies designed to provide resilience to people, businesses or countries. You can keep up to date with the latest developments by signing up to the Parametric Post, the only newsletter dedicated to parametric insurance.

To find out more about CCRIF, visit ccrif.org.