Four challenges facing parametric insurance: why isn’t parametric more widespread?

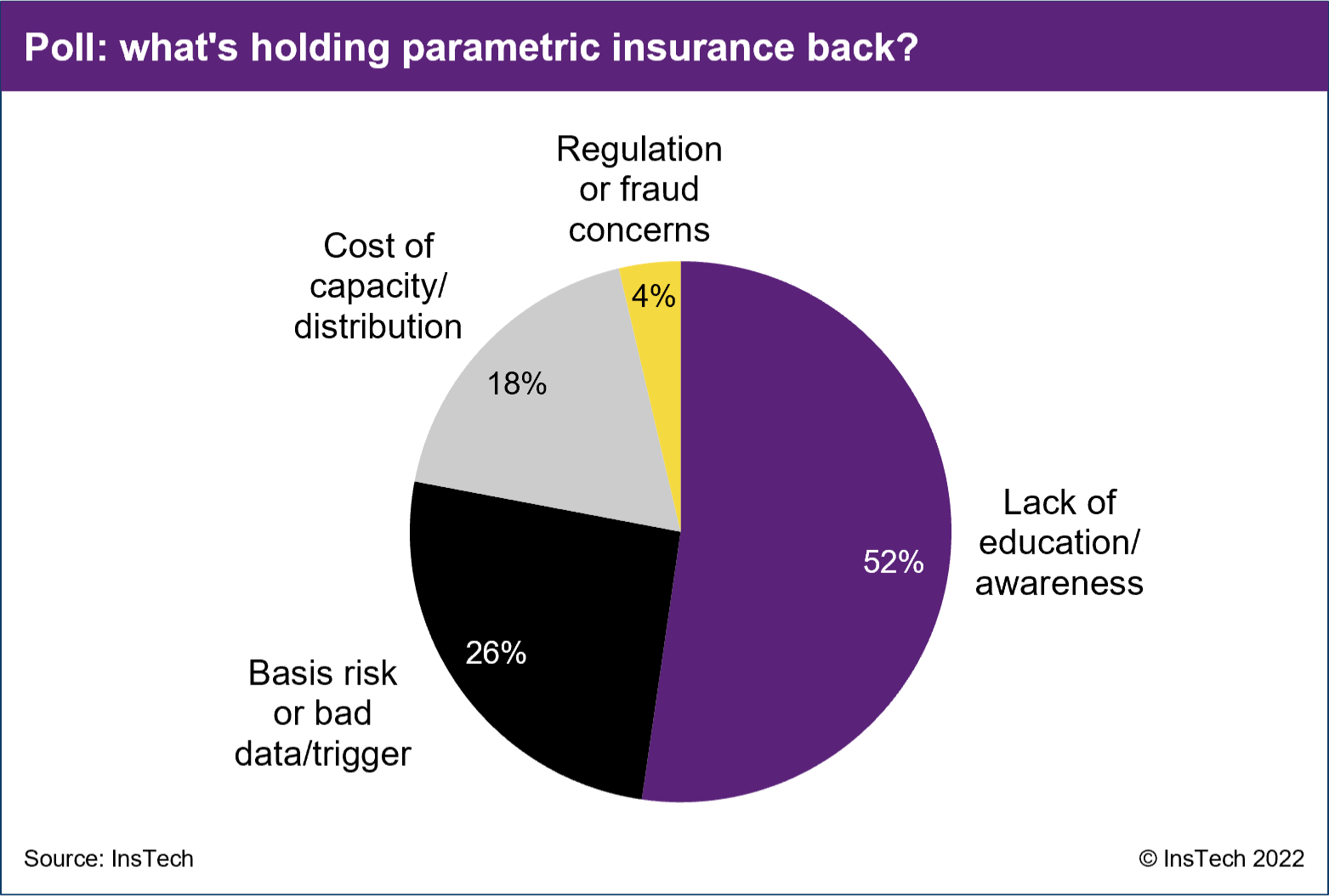

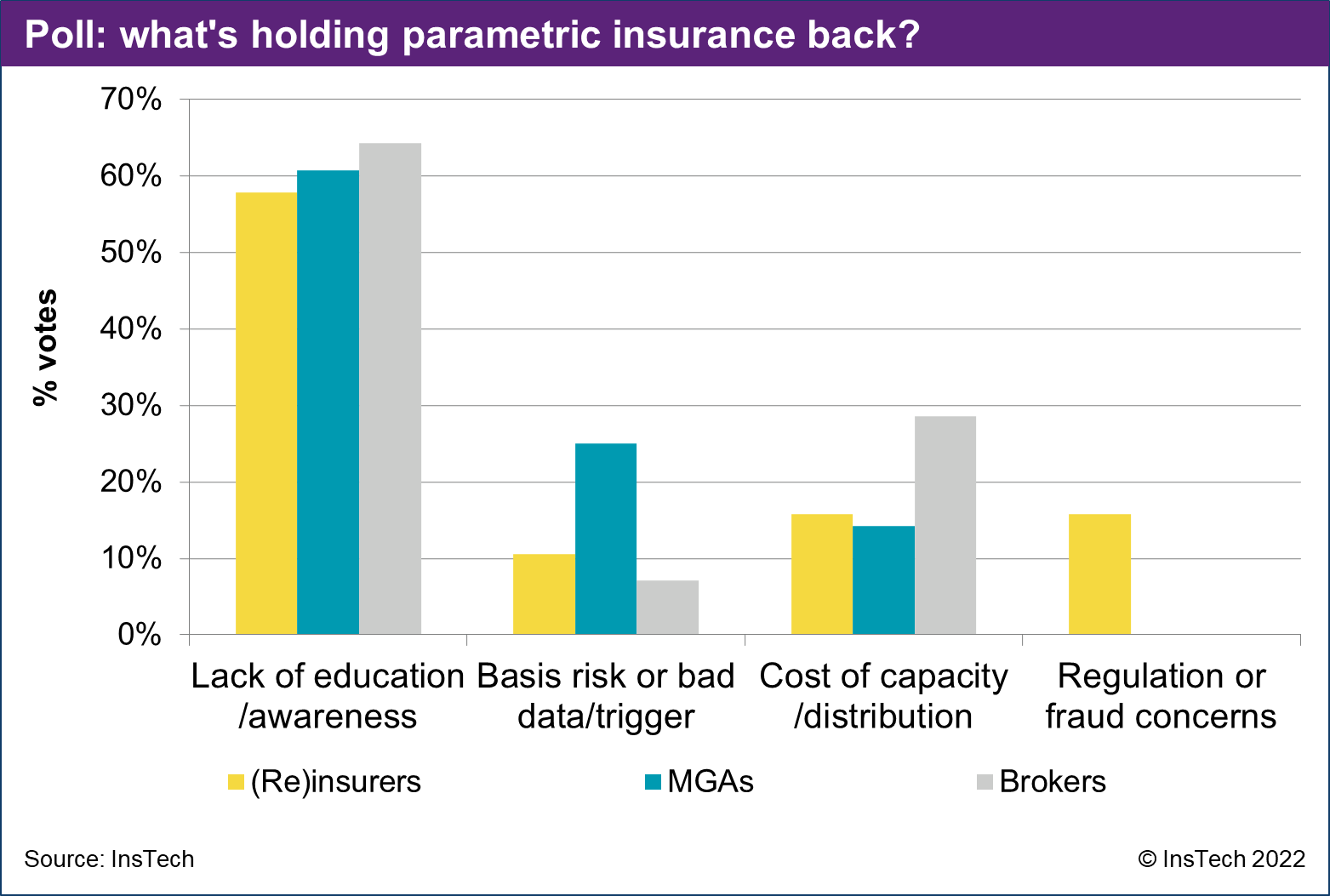

Through the Parametric Post newsletter, InsTech has built a global community of parametric insurance innovators and enthusiasts. Earlier this month, we asked them what they thought the biggest obstacle to the wider uptake of parametric insurance was and lack of education/awareness was the most popular response.

Lack of education or awareness

Most respondents to our poll of the parametric community cited lack of education or awareness as the main factor holding back parametric insurance.

Although the concept of parametric insurance has existed for decades, its primary use has historically been in reinsurance and catastrophe bonds. Many customers are unaware of parametric insurance and much of the insurance industry has only heard about it recently.

Whilst traditional, indemnity-based insurance policies are designed to compensate policyholders for loss, parametric insurance pays out claims based on event triggers. This intrinsic difference makes parametric unfamiliar to those used to traditional insurance products. Progress in educating clients and the industry is being made, due to the intuitive “if-then” pay-out structure of parametric products.

Whilst wholesale brokers and London Market brokers have more experience with parametric insurance, awareness is lower among retail brokers, who deal directly with customers. Making retail brokers sufficiently aware of parametric and familiar with the products to sell to clients is a challenge and a priority for companies that sell parametric insurance through brokers. We spoke to Arbol’s CEO Siddhartha Jha, who said that retail brokers are well placed to pitch parametric products to their clients. Arbol provides parametric insurance solutions for weather risk.

“Once retail brokers are aware of a parametric product, it is important to have an example ready which shows how a product works and what the price is. We built a platform catered to retail brokers which allows them to structure a product and see how it would have paid out in the past.”

While making retail brokers aware of parametric products continues to be a challenge, making it easier to see how pay-outs for their clients could be triggered and calculated helps them determine whether a product is appropriate for their clients.

It is more difficult to provide platforms that allow brokers to structure products in real time for more complex products, such as those involving multiple locations and perils. The risk managers of large corporates most in need of complex products are becoming more familiar with parametric insurance, as Sébastien Piguet, Descartes Underwriting’s Co-founder & Head of Underwriting explained on InsTech podcast episode 165. Arbol also named American farmers and American and European energy companies as examples of companies to whom parametric weather insurance is fairly well known.

Education is a bigger and costlier challenge for parametric products not sold through brokers, but direct to customers. Increasing awareness requires expensive advertising campaigns or alternative distribution channels (such as embedded insurance).

Where protection is most needed, government agencies may raise the profile of parametric products (such as the US Federal Emergency Management Agency’s earthquake resilience graphic featuring Jumpstart Insurance, which provides earthquake coverage in the US).

Lack of education and awareness was the top challenge for parametric insurance among all company types which responded to our poll. It is a universal problem, but it is more acute in some markets than others. It continues to be through brokers that parametric insurance is most successfully sold.

Basis risk and trigger data

Basis risk, the potential difference between a policyholder’s financial loss and the pay-out they receive from their insurer, is often cited as a drawback of parametric insurance. Since pay-outs depend on event parameters rather than the loss itself, customers may receive pay-outs that do not fully reimburse them for the loss suffered. However, basis risk also exists in traditional insurance policies, which feature deductibles, limits and exclusions that result in claim payments being less than the customer’s loss.

The most effective parametric policies are triggered by data which closely correlates to policyholders’ loss – minimising basis risk. This relies on accurate and localised data that reflects how an event impacted a customer in their location.

Advancements in technology have increased the availability of such data for some perils (such as ICEYE’s synthetic aperture radar satellites which measure the high water mark of floods), but for other perils such as hail, data can be a challenge. Installing sensors at the client’s location has sometimes been used as a solution to a lack of quality data. In the past this has been expensive, but lower cost solutions are now being developed.

Some parametric products avoid basis risk by offering partial pay-outs which do not intend to reimburse policyholders for their entire loss. These policies are designed to be used in conjunction with indemnity insurance. For example, Jumpstart Insurance offers maximum pay-outs of $10,000 to individuals and $20,000 to businesses, designed to cover their immediate expenses after an earthquake rather than indemnify them for their entire financial loss.

The growth of parametric insurance in recent years has been driven in large part by the increased availability of data and analytics. Previously, significant basis risk prevented parametric insurance from scaling beyond large-scale reinsurance transactions. The community’s choice of data and basis risk as the second biggest factor holding back parametric suggests that, whilst innovation is improving the data available, there is still room for more and better data to be used in parametric insurance.

Cost of capacity or distribution

Both the cost to insurers of providing coverage (“capacity”) and the cost of selling the insurance (“distribution”) impact the premium prices paid by policyholders.

Distribution (which includes sales and marketing) costs are high for many insurance products. There is some truth to the notion that insurance is “sold, not bought”; customers need to be convinced they need insurance before they consider purchasing it. This is a greater challenge with parametric products, which are unfamiliar to customers and the brokers advising them and may cover perils such as temperature or cyber downtime for which customers have never bought a standalone insurance product in the past.

Insurance capacity, which is the funds provided to underwrite the product, can also be costly for parametric insurance products. Insurers are already exposed to natural catastrophe risk by underwriting property insurance policies. Some of them are reluctant to take on more exposure to catastrophe risk through parametric insurance, which can push up the price of capacity for catastrophe-prone areas. Demand for parametric catastrophe insurance is higher in the most exposed areas, such as flood plains or seismic hazard zones, where coverage will be most costly.

Parametric is expensive for insurers for another reason: parametric policies pay claims more reliably than indemnity insurance. As Richard Phipps, Senior Project and Delivery Lead at Swiss Re, pointed out in the comments of our poll, “parametric always pays out when the trigger is met”, while indemnity insurance does not always pay out whenever there is an insured loss. Claims may not be made for many reasons, such as the policyholder wanting to keep their no-claims discount, not being bothered to gather loss documentation or even forgetting they had insurance, as Richard explained in a 2020 article.

Arbol’s Siddhartha Jha told us, “Many clients are cost-sensitive. They buy parametric insurance as a supplementary product to other insurance, or to smooth out revenue and supply chain fluctuations, but nobody wants to spend a lot of money on this.”

Parametric insurance’s uptake depends on charging premium prices that cost-sensitive customers can afford, but the cost of capacity and distribution for parametric products makes it challenging to set an appealing price for clients who need coverage most, compared to other alternatives or not taking out any cover.

Regulation or fraud concerns

Whilst traditional, indemnity-based insurance policies are designed to compensate policyholders for loss, parametric insurance pays out claims based on event triggers. Much of insurance law has been designed with indemnity-based insurance in mind, and parametric insurance is new to many regulators.

One concern for regulators has been that an event could trigger a pay-out when the policyholder has not experienced any financial loss. Depending on the jurisdiction and the details of the policy, this may be overcome by requiring claimants to confirm they have experienced a loss through a text message or signing a statement of loss.

For some parametric products, fraudulent claims are near-impossible because the trigger is based on third-party data. For example, some parametric earthquake products are triggered by data from government agencies such as the US Geological Survey. Most of those raising concerns about regulation and fraud in our poll were (re)insurers. (Re)insurers are more concerned about parametric products triggered by sensor data, where the sensor is in the client’s possession, because of the potential for manipulation.

Fraud is not an insoluble problem for parametric products triggered by sensors. FloodFlash, which installs flood sensors at policyholders’ locations, uses event response data from JBA Risk Management to ensure sensor readings correlate with known floods. Rachel Hillier, Partner at legal firm Capital Law, which advised FloodFlash on its products, gave her insights on the regulatory and legal framework for parametric insurance in a recent interview.

Does it all come down to cost?

Lack of education and awareness has been the biggest obstacle to the wider uptake of parametric insurance – not because parametric insurance is conceptually difficult to understand, but because it is unfamiliar. Among some groups that had little knowledge of parametric insurance until recently, such as risk managers of corporates, awareness is high and increasing. In much of the insurance industry, over the last few years parametric has progressed from nearly unknown to better understood, especially by those who have been curious about it.

This progress shows that wider awareness is achievable. The challenge is that educating the insurance value chain and the customer is expensive and further increases the price of parametric premiums. Whilst we’ve seen a lot of innovation in parametric insurance in recent years, there is space for innovative approaches to increase awareness of parametric or to provide more efficient capacity, distribution or data offerings so educational initiatives are more affordable.

To learn more about parametric insurance, sign up to the Parametric Post newsletter, which compiles all the latest developments, case studies and insights in parametric insurance every two weeks.

InsTech London’s 2020 report, Parametric Insurance: 2021 outlook and the companies to watch, is available to download, free to InsTech London members who can email [email protected] for a discount code. We will publish an update to this report in Q2 2022.

If you would like to learn more about the companies featured in this article or contribute to future research on parametric insurance including our upcoming report, contact Henry Gale on LinkedIn.