Climate Risk is InsTech’s monthly newsletter dedicated to climate-related insurance news – you can sign up for free here.

Climate and ESG: hot topics for insurers

During July’s week of record-breaking UK temperatures, we hosted our first climate and ESG-focused discussion group.

We were joined by a lively group of insurers, brokers and others to discuss the key ESG issues the insurance industry is facing – now and in the future. Themes emerged, from how to collect and standardise ESG data to investing in carbon removal projects.

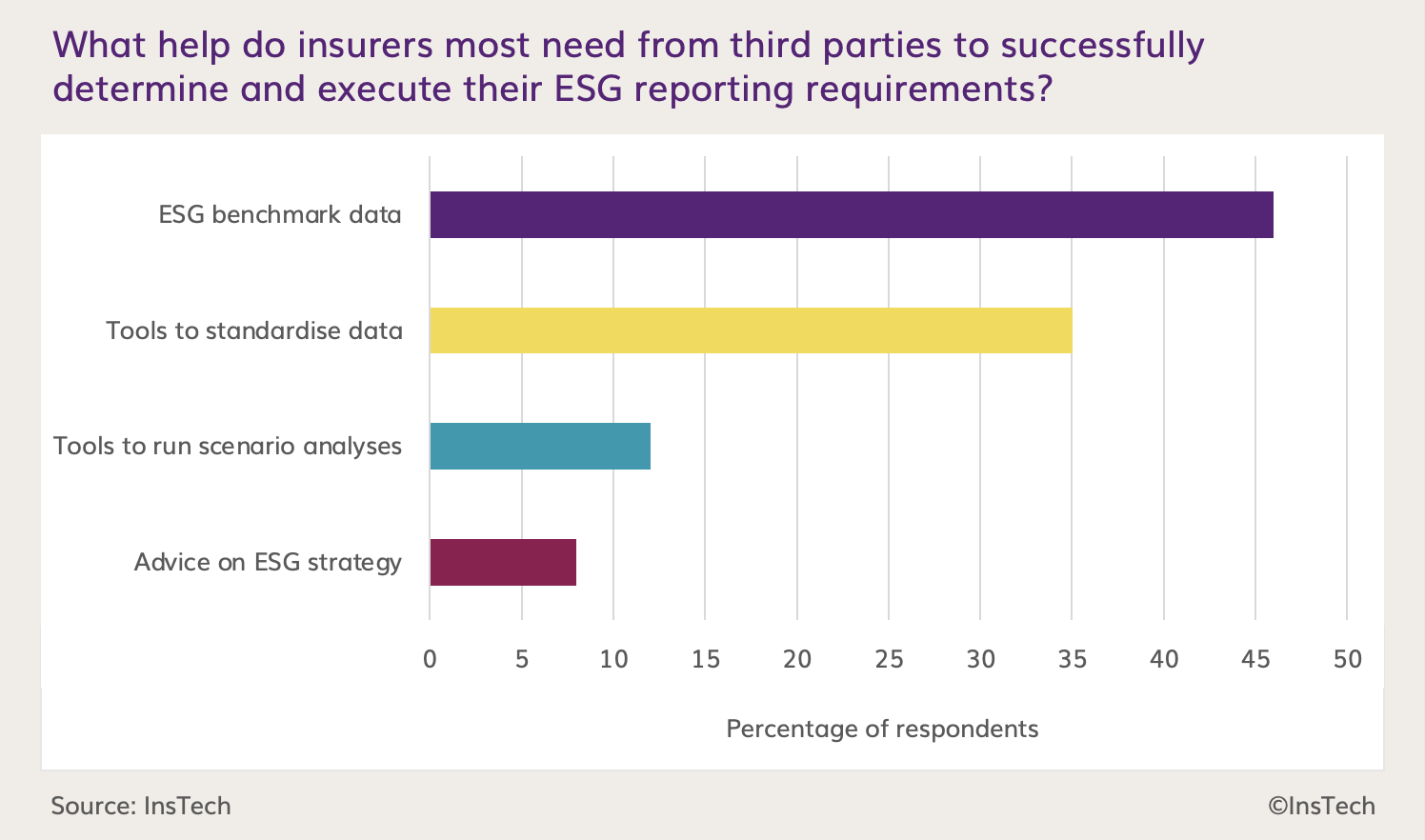

These themes were also reflected in a recent InsTech poll, where we asked the community what help insurers most need from third parties to successfully determine and execute their ESG reporting requirements. 46% of respondents voted for ESG benchmark data, whilst 35% thought tools to standardise unstructured ESG-related data provided by clients would be most beneficial.

There is a lot more to come from InsTech in this space. Keep an eye out for an article coming soon on the key ESG insurance themes we’re seeing, as well as future activities and events.

Tractable: enabling insurers’ sustainability goals

In our interview, Tractable’s Sakina Najmi discusses the company’s new property offering, how Tractable’s AI can be used to improve sustainability and the company’s recent rebrand. Tractable has also partnered with American Family this month. The insurer will apply Tractable’s AI solutions to its claims subrogation settlement process.

Oasis Loss Modelling Framework: democratising catastrophe modelling

In 2012 Dickie Whitaker founded Oasis, a not-for-profit, open-source catastrophe modelling platform. In this discussion, he talks about the organisation’s work on open data standards and parametric insurance, the types of models available on the Oasis platform and how the organisation is working to speed up model run time over 2022.

ICEYE podcast: real-time monitoring from space – fast, accurate and persistent

Stephen Lathrope, ICEYE’s Global Head of Insurance, joined Matthew to discuss how ICEYE is expanding its offering from floods into other natural perils, its ability to acquire information via its constellation of 21 satellites and the benefits of its geospatial platform. The discussion also covers how the company works with partners including Arturo, AXA Climate, Swiss Re and EigenRisk. ICEYE has recently announced that its data and imagery will be explored to provide inputs for parametric flood triggers for a UNDP-backed project in Ghana.

In the news…

Chaucer: 75% more land burnt in European wildfires

According to analysis by the specialty (re)insurer, the land mass burnt by wildfires in Europe increased by 75% from 2019 to 2020. Chaucer also explains that despite this growing risk, wildfire modelling in Europe lags behind the US and Canada. (Re)insurers are therefore having to rely on internal methods for assessing risk.

Generali partners with Previsico

Generali Global Corporate and Commercial (GC&C) has partnered with Previsico to provide enhanced flood resilience to its UK clients. Clients will benefit from a flood dashboard, which displays the predicted time and depth of flooding up to 48 hours in advance, flood warning emails and a water depth sensor for enhanced monitoring in at-risk locations.

Marsh McLennan: 1.5°C global warming to substantially increase flood risk

Marsh McLennan has updated its Flood Risk Index, which features risk scores for 180 countries based on current conditions and for 1.5°C, 2°C and 3.5°C warming scenarios. For example, it shows that 28% of Australia’s economic assets are currently at risk of flood, but this could increase to 52% under a 2°C warming scenario.

Zesty.ai closes $33m USD funding round

Zesty.ai will use the new capital to expand its insurance offerings and develop new products for the real estate market. Kumar Dhuvur, Co-founder and Head of Product, joined Matthew recently on the InsTech podcast to discuss how the company helps insurers to understand climate risks and how personal experiences of wildfires led to the creation of Zesty.ai’s wildfire risk insights.

Tensorflight partners with Airbus to enhance monitoring capabilities

The partnership will see Tensorflight using Pléiades Neo, Airbus’ latest 30cm resolution constellation, to obtain building-related information and detect changes to properties. In our recent interview with Tensorflight, we cover how insurers can access the company’s property insights, and what insurers the company is already working with.

Archipelago releases integrated loss history data with exposure data

The offering will be available on Archipelago’s platform and is intended to reduce problems from inconsistently formatted spreadsheets. The offering will integrate data with a client’s exposures, map losses and build a higher level of granularity and completeness. Underwriters will benefit from being able to quickly understand a client’s loss story.

JENOA adopts RMS flood risk maps for Middle East

The digital broker will use the recently launched RMS Global Flood Maps to give a better understanding of flood risk in the Middle East, amongst other areas. In July, RMS has also appointed Claire Souch as VP Global Models. Her role will involve expanding the company’s core natural catastrophe models, the integration of climate risk factors to them and the application of RMS climate models to the ESG space.

SafeGraph partners with PredictHQ

Under this partnership, PredictHQ’s customers will be able to use SafeGraph’s point of interest and event datasets. This will enable greater accuracy of event insights that are unique to its location, such as how consumers move and spend following a natural catastrophe. To learn more about how Safegraph curates its data and how it can be used in insurance, you can read our article here.

Addresscloud to accelerate perils innovation

Flood modelling specialist, Jill Boulton, has been appointed as an independent consultant to help Addresscloud accelerate its product development strategy and innovation in the predictive and real-time peril modelling area. Jill has over 30 years of experience in the insurance market and has spent the past 15 as the Technical Director at JBA Risk Management.

Aon to embed climate science into European flood models

Through a partnership with the Karlsruhe Institute of Technology (KIT), Aon is embedding climate change considerations into its Impact Forecasting flood catastrophe risk models for Europe. KIT provides a stochastic flood event set for different emission scenarios and time horizons. These scenarios will be integrated into all Impact Forecasting European flood models over the next three years.

BCG and Jupiter Intelligence partner on climate risk analytics

As part of the partnership, Boston Consulting Group (BCG) will incorporate Jupiter’s climate analytics into its ClimateImpact.AI platform, which provides insights to private and public sector clients. Having incorporated Jupiter’s data and analytics, BCG will use its platform to help clients assess transition and physical climate risks, as well as to evaluate risk and cost trade-offs.

e2Value and Betterview extend partnership

Through the partnership, e2Value’s property valuations and replacement cost estimates are available on the Betterview platform. Todd Rissel, Chairman & CEO at e2Value, joined Matthew on the InsTech podcast last year to discuss how the company works with partners and how to maintain customer relationships.