Climate Risk is InsTech’s monthly newsletter dedicated to climate-related insurance news – you can sign up for free here.

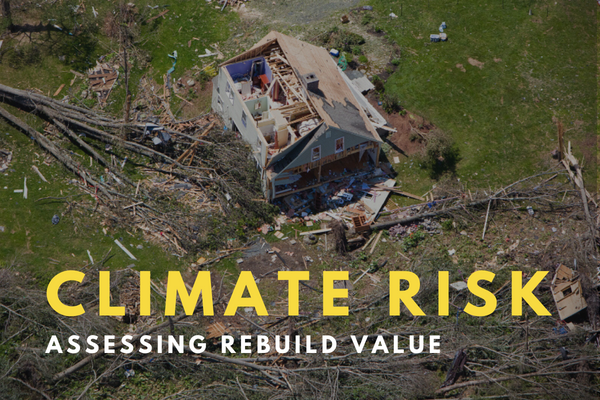

The future of accurately assessing rebuild value

A rebuild value is an estimate of the amount it would cost to completely or partially rebuild a property, which can occur in the wake of a climate-related catastrophe event, water leakage or a house fire. Understanding the rebuild cost of an insured property is critical for making accurate underwriting decisions and ensuring policyholders are paid in full for any losses incurred. If the building is underinsured due to an incorrect rebuild value, customers will be left with a pay-out shortfall.

In our recent report Property Intelligence: the future of accurately assessing rebuild value produced in partnership with CAPE Analytics, we review how property attribute data is used to determine rebuild costs today and in the future. We explore what key factors to consider when determining a property attribute data provider and the potential for new artificial intelligence technologies to improve this data. The report can be downloaded for free here.

Tensorflight: automating property inspections

Tensorflight, founded in 2016, provides imaging-based technology to automate commercial and residential property inspections. Read our interview to find out how insurers can use Tensorflight’s offering, the challenges of getting accurate property data and which insurers the company is already working with.

Parametric Insurance in 2022: the 150+ Companies to Watch

InsTech’s latest report exploring the growth of the parametric insurance market is now available to download. The report features over 100 pages of insights, including where investment is going, opportunities for innovation and descriptions of what more than 150 companies active in the space are offering. The report is free to InsTech members and available to buy for £500.

AXA Climate & CoreLogic: Hailstorm parametric insurance – Podcast 192

AXA Climate has announced plans to expand its parametric hail product in France and Australia using Hailios’ hail sensors. On podcast episode 192, Matthew was joined by AXA Climate Underwriter Mia Vioulès and CoreLogic’s Robert Schablik to discuss how the two companies are providing parametric insurance for property damage and business interruption caused by hailstorms. They also discuss how the AXA Climate School helps clients understand their climate change exposure.

In the news…

Zurich expands Previsico partnership for public sector customers

The partnership will allow Zurich Municipal to provide public sector customers with free surface water flood warnings. These are specific to individual properties and provided up to 48 hours in advance. The deal will also help to support local governments with warnings for roads and parks. Zurich and Previsico originally announced a partnership in 2021 to provide flood forecasting for its private sector clients such as BT.

Over 72% of southeast US residential roofs susceptible to hurricane damage

Arturo’s recent report analysed over 17 million single-family residences across Texas, Louisiana, Mississippi, Alabama, Florida, Georgia and South Carolina. The findings show that 72% of rooftops in these states are asphalt shingle, which can only withstand wind speeds up to 110 mph, or Category 3 force winds.

IHS Markit event: navigating maritime risk

New and emerging risks such as pandemic impacts and increasing climate-related events are affecting the maritime industry. On 6th July, IHS Markit is hosting a webinar to discuss trends affecting marine insurers and how to support the best ESG practices in the industry.

Kita raises £350k in pre-seed round

Kita, a startup aiming to provide insurance for the voluntary carbon markets, has closed a £350,000 pre-seed round led by Insurtech Gateway. The investment will be used to accelerate Kita’s carbon insurance product launch and recruitment. The company is currently participating in cohort eight of the Lloyd’s Lab and was on stage at our event in London on 24th May.

JBA partners with Chedid Re

Through the five-year partnership, reinsurance broker Chedid Re will use JBA’s global flood model to provide flood risk analytics and catastrophe modelling services to clients across the Middle East, Africa and South Asia.

$3.5bn USD insured losses from Australian floods

The Insurance Council of Australia has raised its claims cost estimate from the floods earlier this year, causing PERILS AG to increase its insurance industry loss estimate to $3.5 billion USD. The floods, which occurred over February and March 2022, are now the fourth most costly natural disaster Australia has experienced.

ICEYE launches flood geospatial platform

The platform, ICEYE Insights, will allow insurers to combine ICEYE’s flood observation data and analysis with their property insurance information to understand the impact of a flood event. The platform uses the EigenPrism catastrophe risk management tool.

McKenzie Intelligence Services partners with Fugro

Fugro will provide McKenzie Intelligence Services (MIS) with high-resolution aerial imagery immediately after disasters. This will complement MIS’s existing imagery and data sources that feed its Global Events Observer (GEO) platform.

Speedwell creates weather-based indices for renewables

Climate data provider Speedwell Climate (previously Speedwell Weather) has partnered with the European Power Exchange to launch weather-based power indices to provide risk management and hedging opportunities to the renewables sector. Speedwell is profiled in our recent parametric insurance report.

Fathom partners with CIWEM

The Chartered Institution of Water and Environmental Management (CIWEM) is a UK-based professional body dedicated to the sustainable management of the environment. Through combining Fathom’s flood risk expertise with CIWEM’s membership program, they are co-developing educational resources including a CPD accredited course.