The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… cyber perils: an opportunity for parametric risk transfer?

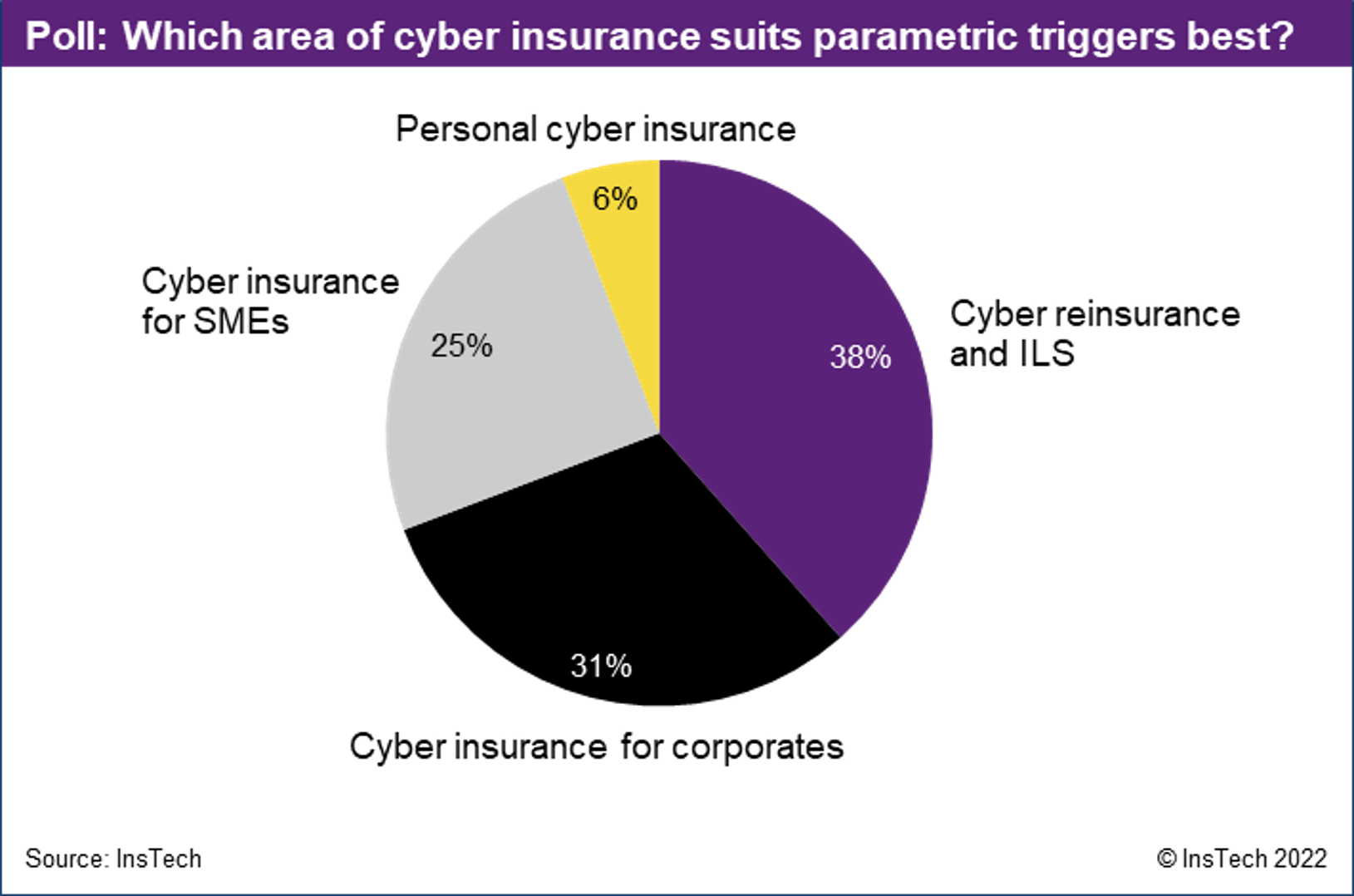

Parametric triggers can be used to protect against losses caused by cyber downtime and data breaches. So far there have only been a few examples of cyber insurance products and deals using parametric triggers. In a LinkedIn poll, we asked the parametric community what area of cyber insurance parametric triggers were most suited to.

Reinsurance and insurance-linked securities (ILS) was the most popular answer. Insurance-linked securities are financial instruments that allow insurers and reinsurers to transfer risks to capital markets. In our recent spotlight interview, cyber reinsurance MGA Envelop Risk said it was keen to support cyber ILS transactions. There have been few cyber ILS transactions so far but there is high interest in transferring systemic cyber risks to capital markets.

Companies such as Parametrix have recently started underwriting cyber downtime insurance for corporates and SMEs, which covers business interruption losses during downtime of third-party service providers such as cloud. Blink Parametric also provides SME downtime insurance solutions as well as a personal online data monitoring and insurance solution that protects individuals against data breaches and cyber crime.

Parametric risk transfer solutions depend on reliable data for risk modelling and triggering pay-outs. Developments such as CyberCube’s new patent for network monitoring, featured in this issue, can support the development of parametric solutions and, according to CyberCube’s Juan Marcano, “unlock much-needed capital” for the cyber insurance sector. InsTech will publish a report on cyber insurance later this year. If you’re underwriting cyber insurance or building data or models, please get in touch at [email protected].

Download InsTech’s “Parametric Insurance in 2022” report now

InsTech report

InsTech’s new report, “Parametric Insurance in 2022: the 150+ companies to watch”, is available to download. It includes an overview of parametric insurance trends, what has changed since our previous report in 2020 and details of more than 150 companies providing parametric insurance solutions. You can download a preview of the report on InsTech’s website. The report is free to InsTech corporate members, who can log in to download a copy. Everyone else can purchase the report for £500.

Oasis Loss Modelling Framework: democratising catastrophe modelling

InsTech interview

Dickie Whitaker, Chief Executive of Oasis Loss Modelling Framework, speaks to InsTech’s Ali Smedley about open data standards, climate-conditioned catastrophe models and parametric risk transfer. Oasis Loss Modelling Framework is a not-for-profit, open-source catastrophe modelling platform.

In the news…

CyberCube patent to enable parametric cyber risk transfer

Cyber • Catastrophe bonds

CyberCube, which is advising insurers and capital markets about possible structures for parametric cyber catastrophe bonds, has been issued a patent in the US for monitoring network services providers. In its patent application, CyberCube said new processes and technologies were needed for monitoring networks because “there is no available solution to provide robust, auditable, reliable measurement of downtime” for the ILS market. CyberCube creates risk models for cyber risks such as downtime and could also validate when a trigger event occurs, acting as the calculation agent on a parametric cyber catastrophe bond.

Over 10,000 parametric lost luggage policies sold in UK

UK • Travel

Blink Parametric launched Smart Luggage, a parametric insurance product for luggage lost during flights, in August 2021 in partnership with broker Just Travel Cover and insurer Financial & Legal. In Blink’s latest case study, Just Travel Cover reveals that over 10,000 policies have been sold. Smart Luggage customers receive a pay-out of £50 GBP if their luggage is not located after 30 minutes, and £500 GBP after 48 hours.

ICEYE launches portfolio flood impact tool

Flood • Reinsurance • Catastrophe bonds

ICEYE, which provides flood depth data to insurers using satellite imagery and third-party data, has launched a tool to help companies understand the impact of a flood across a portfolio of buildings. Insurers can upload details of their property portfolio through an API. This could be used for parametric triggers in reinsurance or ILS contracts based on a flood’s impact across an insurer’s property portfolio. This weekend we are releasing a podcast interview with ICEYE’s Global Head of Insurance Stephen Lathrope.

Parsyl opens London office to support syndicate expansion

UK • Supply chain • InsTech podcast

Parsyl, which offers cargo insurance policies including a parametric temperature trigger for perishable cargo, has opened a London office. Parsyl raised $25 million USD in January 2022 and announced an expansion in scope of its Lloyd’s syndicate 1796, which its new London staff will support. You can learn more about Parsyl by listening to or reading our interview with CEO and Co-founder Ben Hubbard on InsTech podcast episode 123.

LexisNexis flight data available on blockchain through Chainlink

Travel • Blockchain

Data provider LexisNexis has made its flight tracking data available on the Chainlink Network. It can now be used for blockchain-based parametric insurance contracts. LexisNexis’ flight data includes departure and arrival times, delays and cancellations. The Chainlink Network connects blockchains to “off-chain” data, enabling blockchain-based parametric insurance contracts to be triggered by real-world inputs such as flight information.

ACRE Africa to use blockchain for all parametric policies

Kenya • Weather • Agriculture

Microinsurance company ACRE Africa’s pilot of using blockchain-based smart contracts for parametric rainfall insurance covered over 12,500 smallholder farmers in Kenya. A new case study reveals that ACRE Africa’s cost of distribution and claims processing was reduced by 80%. 40% of claims were paid within 24 hours and 53% of participating farmers reported increased trust in insurance. ACRE Africa, which is working with Chainlink and Etherisc, has announced it will use blockchain for all its parametric products going forward.

New parametric hurricane reinsurance product for Caribbean

Caribbean • Hurricane • Reinsurance

Aura Underwriting, an MGA specialising in Caribbean property insurance, has launched a hurricane reinsurance product available across the Caribbean. Pay-outs are made when category 3 or above hurricanes pass within 40 miles of a policyholder’s location. Available limits are between $500,000 and $5 million USD, although Aura says higher limits may be available on request.

Rainfall triggers pay-outs in Chinese province Guangdong

China • Flood

Extreme rainfall has triggered parametric pay-outs to sixteen prefectures and cities in Guangdong, China. Guangdong has a parametric insurance scheme that insures its cities and agricultural communities against tropical cyclones and excess rainfall. The pay-outs to date are estimated to be worth $40 million USD. Additional pay-outs are expected when data is available for more recent rainfall. Guangdong’s parametric insurance scheme previously paid out after Typhoon Haima in 2016 and Typhoon Mangkhut in 2018.

Rainfall coverage pilot launched for Chinese province Henan

China • Flood

Henan is the latest Chinese province to launch a parametric insurance pilot for its cities and municipalities. Henan’s provincial government has announced that the scheme will provide cover for extreme rainfall and floods. It is being launched in areas badly affected by rainfall and floods in 2021. A panel of Chinese insurers including PICC, China Life, China Pacific and Ping An are providing insurance capacity.

REVO-SPAC launches its first parametric product

Italy • Weather

REVO-SPAC, a special-purpose acquisition company focused on SME parametric insurance, has launched its first parametric product. REVO-SPAC raised €220 million EUR in its initial public offering according to PitchBook and acquired Italian insurer Elba Assicurazioni in 2021. Its new product, “Protezione Estate” (“Summer Protection”), covers outdoor bathing establishments against business interruption losses caused by rainfall. It is being sold through Italian broker GBSAPRI.

Oko raises $500k to expand to Côte d’Ivoire

Côte d’Ivoire • Weather • Agriculture

Oko, which designs and distributes weather index insurance products for smallholder farmers in Africa, has raised $500,000 USD. The funding is an extension of its $1.2 million USD seed round in April 2021. Oko currently offers drought and excess rainfall insurance underwritten by Allianz in Mali and Uganda. It plans to use the funding to launch its products in Côte d’Ivoire.

Gallagher Re launches parametric solutions practice

Climate

Reinsurance broker Gallagher Re has established a “Public Sector & Climate Resilience Solutions” practice, which will be responsible for structuring and placing parametric risk transfer solutions. In coordinating parametric solutions from its climate resilience practice, Gallagher Re is following Howden and WTW.

Find out what you’ve missed…

Issue 27 – Growing regulatory recognition of parametric insurance

Issue 26 – A growing business model for parametric insurance tech companies

Issue 25 – What’s your embedded parametric insurance product idea?

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.