The Parametric Post is InsTech London’s newsletter dedicated to parametric insurance. Sign up for free using the form at the bottom of the page. This week’s issue (24 June) features coverage for wind turbines and forests, plus the latest product and partnership announcements.

We have also profiled over 50 companies active in the parametric insurance space in our report Parametric Insurance – 2021 outlook and the companies to watch, which is available to download. The report is free to InsTech London corporate members, who can contact [email protected] to get access.

Thought for the day… parametric insurance for climate-friendly assets

Initiatives to tackle climate change, such as carbon sequestration and renewable energy, have insurance needs which new parametric products are being designed to meet. Parametric coverage options for wind turbines and forests against natural hazards are featured in this issue.

The role of parametric insurance in renewable energy

Wind farms need to be built where winds are reliably strong, but these areas may also be prone to hurricanes or other natural catastrophe risks. When wind turbines are damaged during construction or operation, revenue is lost immediately. AXA XL is working with operators to design parametric insurance solutions to provide fast payouts.

InsTech Podcast 143: insuring carbon sequestration in forests

Forests make up 30% of land and are largely uninsured. Matthew spoke to Marine Utgé-Royo, Chief Strategy Officer and Co-founder of Tesselo, about making more efficient insurance products including parametric to protect forests against risks including storm, fire, drought and pest attacks.

Fathom’s hazard maps used for Global Parametrics flood depth index

Toby Behrmann, Head of Partnerships and Innovation at Global Parametrics, discusses how the company is using Fathom’s hazard maps for its flood depth index. The index is being used for its parametric policy in the Philippines, with plans for future use in Indonesia and Sudan.

Parametrix enters Japan with Sompo partnership

Parametrix, which provides parametric insurance products for IT downtime, has announced a partnership with Japanese insurer Sompo. Its products, which have been available in Israel, the US and Europe, will now be sold in the Japanese market. We spoke to Parametrix’s CTO Neta Rozy about how they choose their partners in podcast episode 115.

CCRIF’s 23 members renew over $1bn of coverage

The Caribbean Catastrophe Risk Insurance Facility (CCRIF SPC), which provides parametric natural catastrophe coverage for governments and agencies in Central America and the Caribbean, has announced that its members have renewed their coverage for the start of the Atlantic hurricane season. This is the second year member countries have ceded over $1 billion of coverage to the facility.

Weather index insurance for Australian farmers

Hillridge Technology has launched a weather index insurance platform for farmers. We have spoken to Founder and CEO Dale Schilling, who told us he was inspired to start the business after his father’s farm was affected by the 2000s Australian drought. Hillridge has partnered with Mitsui Sumitomo and Marsh subsidiary Victor Insurance Australia on the platform.

Parametric hurricane product launched in Dominica

The Climate Resilience Execution Agency for Dominica has worked with Global Parametrics to launch Flexible Hurricane Protection. The product is targeted at small businesses. It pays out based on storm strength, with the policy managed by a smart contract on a blockchain.

China earthquake triggers parametric payout

Yunnan in southwest China experienced earthquakes on May 21st and 22nd, one with magnitude 6.4. This triggered the provincial government’s parametric insurance policy, which paid out 40 million RMB, equivalent to US$6.2 million.

$50m earthquake catastrophe bond transaction

The details of a parametric catastrophe bond for Californian earthquakes have been finalised. Issued by Wrigley Re, a special purpose insurer established for the transaction, the $50 million bond covers a real estate property portfolio owned by investor Blackstone. Hannover Re is the ceding reinsurer. It will have an initial expected loss of 0.99% and a coupon rate of 2.4%.

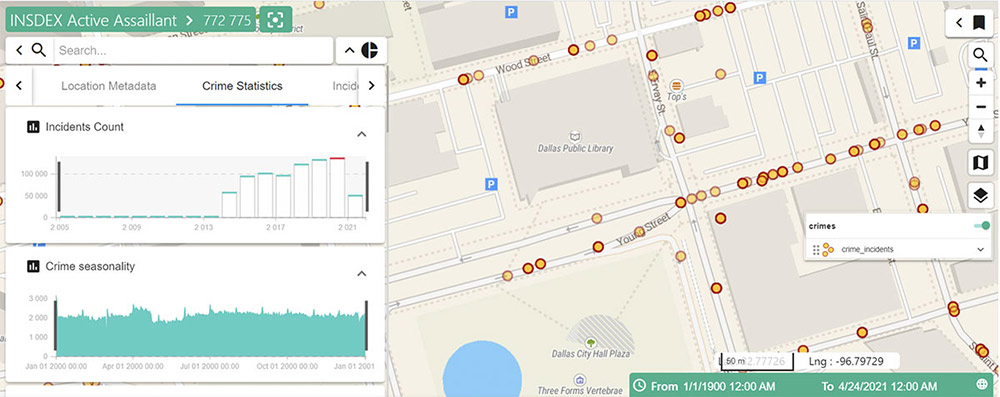

Active assailant coverage from Skyline Partners and AEGIS London

Skyline Partners and AEGIS London have announced a new type of parametric product to cover active assailant attacks. It pays out based on defined shooting and violent events.

The companies have developed an index using data from the Dallas Police Department. The product is targeted at the US market and is being launched initially in Dallas, Texas.

Chainlink partnership for decentralised parametric reinsurance

Blockchain-based reinsurance platform Uno Re has partnered with decentralised oracle network Chainlink to offer parametric products triggered by smart contracts.

If you would like to receive the latest news, stories and insights on parametric insurance every two weeks, sign up using the form below.