The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… protecting supply chains with parametric insurance

Germany • Supply chain

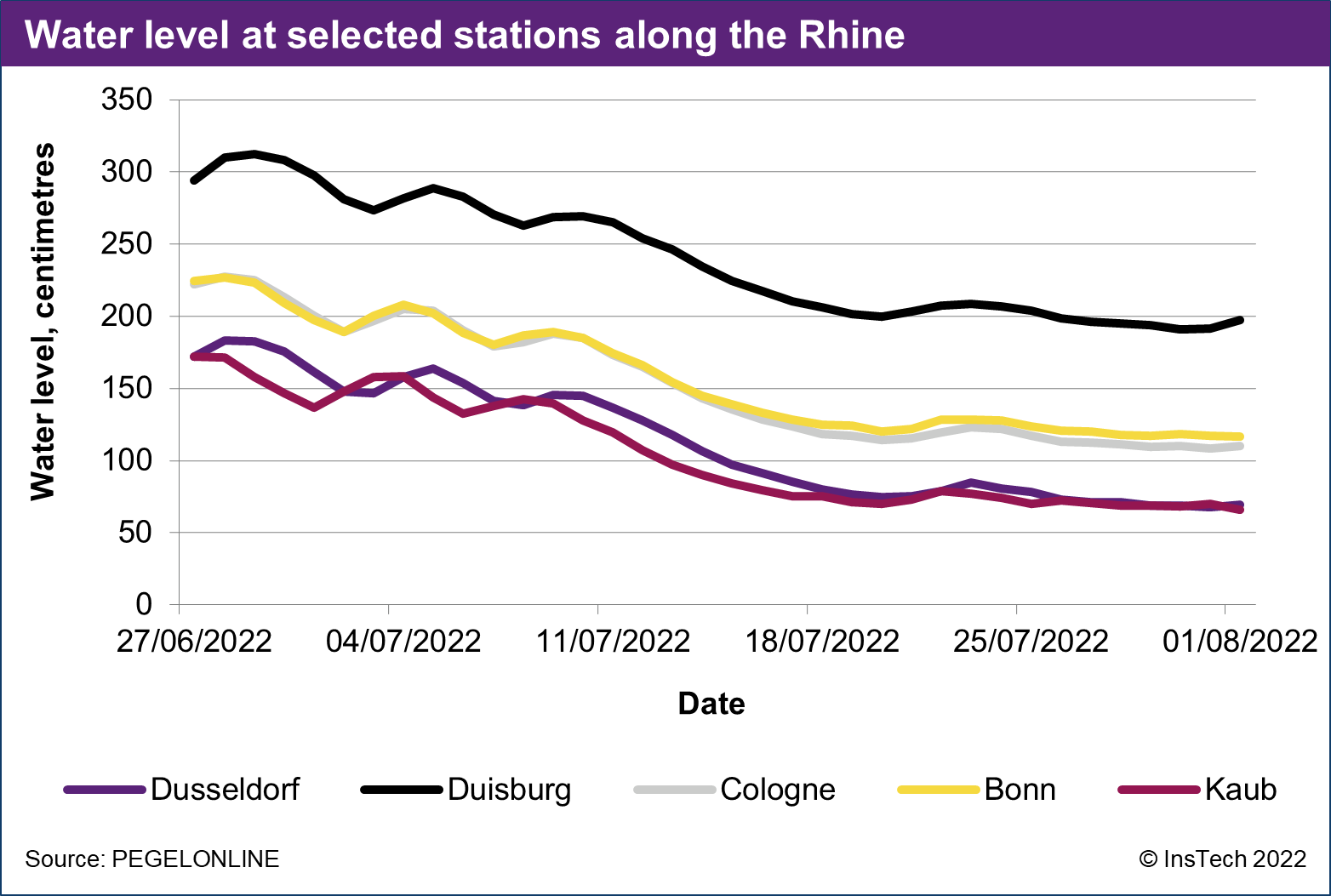

When major shipping routes are disrupted, losses occur across many industries that depend on international trade. Some parametric insurance policies use water levels at key shipping routes as triggers. When a river drops below an agreed water level, set at a depth likely to cause disruption to shipping, the policyholder receives a pay-out to compensate for business interruption losses.

In recent weeks, soaring temperatures have led to reduced water levels in Germany’s Rhine. At Kaub, a key bottleneck, the river is at its lowest since 2007. At these levels, some ships have to travel with reduced freight. Looking ahead, an even greater drop could lead to parts of the river becoming impassable. Reports indicate that recent low water levels have contributed to supply problems for oil, coal and rapeseed.

In our article earlier this year, Swiss Re’s Martin Hotz and Lockton’s Diego Monsalve said successful parametric natural catastrophe pay-outs were driving the uptake of parametric catastrophe coverage globally. As temperature and rainfall patterns continue to change, low water levels in rivers will cause more supply chain disruption. If parametric policies are seen to make appropriate and timely pay-outs, the adoption of water level parametric products is likely to increase.

Making parametric payments frictionless

Payments • Business interruption • InsTech podcast

“The essence of parametric insurance is a data point and a payment.” InsTech podcast episode 201 includes the highlights of our event “Making the Most of Payments Technologies” sponsored by Mastercard and Stripe. Mastercard’s Insurance Enterprise Partnerships team and Imburse’s Chief Product Officer describe how payments technologies can improve the customer experience when a parametric policy is triggered. Alice Glenister explains how Mastercard’s transaction data insights are being used to create parametric non-damage business interruption insurance policies.

In the news…

Raincoat raises $4.5m seed funding led by Anthemis

US • Latin America • InsTech podcast

Raincoat, which develops embedded parametric insurance products for individuals and businesses, has raised $4.5 million USD in seed funding. The round was led by Anthemis. Raincoat’s initiatives include a parametric flood insurance product for smallholder farmers in Colombia and extreme weather protection for farmers in Mexico. You can learn more about Raincoat by listening to our interview with CEO and Co-founder Jonathan Gonzalez on InsTech podcast episode 183.

Alberta Blue Cross to offer Blink’s flight delay solution

Canada • Travel • InsTech interview

Alberta Blue Cross, a not-for-profit benefits and insurance provider in Alberta, Canada, has launched a parametric flight delay service for its policyholders, delivered through Blink Parametric’s software solutions. Blink provides white-label parametric insurance solutions for insurers and brand partners. It has partnered with Alberta Blue Cross on other parametric flight disruption services since 2018. You can learn more about Blink by reading our recent interview with CCO Carl Carter.

Descartes opens Madrid office for Iberia and LatAm

Iberia • Latin America • InsTech podcast

Parametric insurance MGA Descartes Underwriting has opened an office in Madrid to expand its coverage in Iberia and Latin America. Descartes, headquartered in Paris, already has offices in London, New York, Houston, Denver, Atlanta, Singapore, Sydney and Hong Kong. It has raised $142 million USD to date, according to PitchBook. Descartes’ Co-founder and Head of Underwriting Sébastien Piguet spoke about the company’s international expansion on InsTech podcast episode 165.

UNIQA subsidiary launches flight disruption product with baoba

Germany • Hungary • Travel

CHERRISK by UNIQA, which sells consumer insurance online to customers in Germany and Hungary, has partnered with start-up baoba to launch a parametric flight disruption solution for CHERRISK’s customers. Baoba, founded in 2022, operates a marketplace connecting insurers, technology companies and travel agencies. The parametric product uses technology from Blink Parametric, another of baoba’s partners.

CCRIF’s member governments renew over $1.2bn of coverage

Caribbean • Central America

The Caribbean Catastrophe Risk Insurance Facility (CCRIF), a multi-country risk pool, has announced that its member governments have renewed over $1.2 billion USD in parametric coverage for the 2022/23 policy year. Thirteen members increased their coverage compared with the previous year. CCRIF offers parametric earthquake, hurricane and excess rainfall to governments in the Caribbean and Central America.

Start Ready disburses nearly £600k for climate aid

Pakistan • Zimbabwe • Humanitarian aid

Start Ready, a risk pool that uses parametric triggers to provide funding to aid agencies when a climate shock is predicted, has made four pay-outs. Start Ready was set up at COP26 as a predictive disaster risk financing initiative; different to the usual approach to parametric risk transfer when pay-outs are triggered after loss events. £599,357 GBP in aid funding pay-outs has been triggered by predicted heatwaves in three areas of Pakistan and a predicted drought in Zimbabwe.

6 parametric MGAs to pitch for Lloyd’s Lab inclusion

UK

The ninth cohort of the Lloyd’s Lab innovation accelerator programme will be decided after 14 shortlisted companies present at the upcoming pitch day. We were delighted to be able to support Lloyd’s in identifying potential Lab applicants. Six parametric insurance MGAs, all profiled in InsTech’s recent parametric insurance report, will be pitching: OTT Risk, Innovatrix Capital, Sola, Yokahu, Anansi and Climatica.

Analytics partnership for parametric life sciences start-up

UK • Life sciences

Innovatrix Capital, founded in 2021 and one of the companies selected for the Lloyd’s Lab pitch day, has announced its partnership with life science analytics company Innoplexus. Innovatrix Capital is using Innoplexus’ clinical trial prediction analytics to create a parametric risk transfer product for life sciences companies.

PCRIC seeks parametric drought index structurer

Pacific • Drought

The Pacific Catastrophe Risk Insurance Company (PCRIC), a multi-country risk pool, is looking for a company to help it design a parametric drought insurance product. PCRIC plans to launch the product to Pacific Island Countries in early 2023. The company will create the parametric index, trigger mechanism and monitoring system, conduct a country-level risk assessment and serve as the calculation agent. The deadline for submitting expressions of interest is 8 August 2022.

California Wildfire Fund goes without reinsurance in 2022

US • Wildfire • Reinsurance

The California Wildfire Fund, a wildfire risk pool for Californian utility companies, has not purchased any reinsurance or risk transfer for 2022. The Wildfire Fund is understood to have explored coverage options from reinsurance and capital markets and could not find a suitable structure or price. It did not purchase reinsurance or risk transfer in 2020 or 2021 for the same reason. The California Earthquake Authority, which manages the Wildfire Fund, has purchased several catastrophe bonds with indemnity-based or industry loss index triggers.

NZ broker purchases parametric earthquake cover for itself

New Zealand • Earthquake

Velocity Financial, a property, mortgage and insurance broker based in Wellington, has announced it has bought parametric insurance to protect itself from business interruption losses. Velocity’s blog post says in the event of a severe earthquake in Wellington, its “income will dry up for months… if not years.” Its coverage has a limit of $300,000 NZD, with a full pay-out triggered by ground shaking of 30cm/s.

Find out what you’ve missed…

Issue 30 – Parametric risk transfer through marketplaces and exchanges

Issue 29 – Cyber perils: an opportunity for parametric risk transfer?

Issue 28 – Growth of parametric insurance in Africa

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.