The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… responsibility to fund parametric programmes?

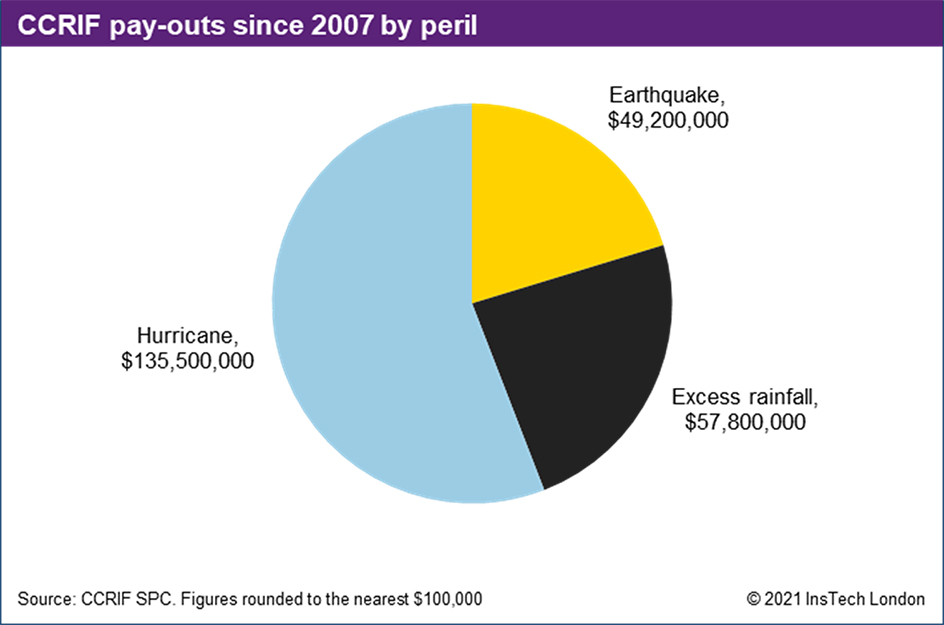

In the aftermath of Haiti’s recent earthquake, its government received $40 million from the Caribbean Catastrophe Risk Insurance Facility (CCRIF SPC), an organisation whose financial backers have included the World Bank, the US, Canada, the UK, France, Germany, Ireland and the EU. Delphine Traoré, non-executive director of the African Risk Capacity (ARC) recently said, “There’s a responsibility for G7 countries to support Africa in managing the impact of climate change by, for example, providing sovereigns with parametric insurance premium finance to help them respond swiftly and decisively to crises fuelled by climate change on the continent.”

Multi-country risk pools such as CCRIF and ARC have shown how mainstream capital markets and insurers can successfully provide liquidity to emerging economies following natural disasters. But as climate change, caused in large part by the emissions of the richest, makes catastrophes more frequent and severe, wealthy countries may be expected to contribute more to sustain these programmes.

Building resilience: CCRIF’s $40m post-earthquake pay-out to Haiti

Haiti • Earthquake • InsTech insight

The Caribbean Catastrophe Risk Insurance Facility (CCRIF) has made its largest single pay-out to date: $40 million to Haiti’s government following the recent 7.2 magnitude earthquake. In this article we compare this to previous CCRIF pay-outs and examine the success of parametric risk pooling.

Parametric insurance: the distribution challenge

InsTech podcast

“The insurers are really keen on parametric insurance… I don’t think anyone’s cracked distribution at scale yet.” InsTech London partners Robin Merttens and Matthew Grant offer their insights on creating and selling parametric insurance products as guests on The Future of Insurance Podcast.

In the news…

Swiss Re partners with reask on parametric hurricane coverage

Hurricane • InsTech podcast

Swiss Re Corporate Solutions has partnered with analytics company reask to expand its STORM parametric windstorm coverage outside the US and Caribbean. Swiss Re will use reask’s newly-announced calculation agent product Metryc for policies in new areas. Matthew interviewed reask co-founders Nick Hassam and Thomas Loridan earlier this year on podcast episode 127.

Parametrix brings downtime insurance to Europe with ELEMENT

Europe • Business interruption • InsTech podcast

Parametrix Insurance, an MGA providing coverage for IT downtime, is to expand into Europe after partnering with German insurer ELEMENT and brokerage platform FINLEX. Parametrix raised $17.5 million in its Series A funding round earlier this year. CTO and co-founder Neta Rozy was featured on InsTech London podcast episode 115.

Hurricane Ida: some parametric exposure

US • Hurricane • InsTech podcast

Hurricane Ida made landfall in Louisiana on Sunday, with maximum sustained winds of 150 miles per hour and minimum central pressure of 930 mb. According to Artemis, insured losses of over $10 billion are expected, with some parametric policies potentially triggered. Evan Glassman, co-founder of New Paradigm Underwriters, explained on podcast episode 138 how his company uses a network of anemometers across the US east coast for its parametric hurricane policies.

Fiji product launch event

Fiji • Agriculture • Weather

Fiji’s first parametric microinsurance product has been formally launched at an event hosted by the UN Capital Development Fund and featuring Fiji’s economy minister. The product protects low-income farmers and fishers against natural catastrophes and extreme weather. 150 farmers have registered for the product within its first two weeks.

FloodFlash plans North America expansion

North America • Flood • Sensors

65% of households in US flood zones do not have flood insurance. UK-based FloodFlash is planning to expand its parametric flood cover to North America. The company has built and tested a miniature version of its flood depth sensor in locations across the US and Canada, to see whether it would work on different mobile networks. FloodFlash is inviting potential US customers to register for early access.

Index insurance pilot in Pakistan

Pakistan • Agriculture • Weather

Blue Marble Microinsurance, which already provides index insurance to farmers in Africa and Latin America, has launched a pilot programme in Pakistan. Blue Marble has partnered with local insurer Asia Insurance and microfinance organisation Reap Agro on the pilot, which will cover 500 smallholder farmers against risks including drought and excess rainfall. There are 4.9 million smallholder farmers in Pakistan.

Parametric earthquake insurance: “a safety net you can rely on”

US • Earthquake • InsTech podcast

“Earthquakes can drain your bank account,” says a recently published infographic from the US’s Federal Emergency Management Agency (FEMA). The graphic is part of a series of materials to promote financial resilience to catastrophes and was developed in partnership with start-up Jumpstart. It promotes parametric insurance as a safety net to help pay for immediate repairs in the event of an earthquake. We interviewed Jumpstart’s CEO and founder Kate Stillwell for podcast episode 104.

Importance of gender inclusion in index insurance uptake

Africa • Agriculture • Weather

43% of the world’s smallholder farmers are women, but challenges such as a lack of mobile phone access and land ownership rights make index insurance products less accessible for women. ACRE Africa’s Jean Eyase writes about strategies to address the gender resilience gap and improve uptake of index insurance among women farmers.

Howden focuses on humanitarian catastrophe bonds

Catastrophe bonds • Volcanic eruption

In March 2021, the first catastrophe bond covering volcanic eruptions was issued for the Danish Red Cross, brought to market by broker Howden Group Holdings. The bond has a parametric trigger, and Howden Group is now looking at more ways to use catastrophe bonds for humanitarian funding and other types of disaster relief.

Do you have a parametric story to share?

Our team at InsTech London is working with companies providing or using parametric solutions around the world. We’re helping to demystify this fast-evolving topic and are tracking all credible (and some incredible) solutions and applications. Whether you are in your early stages and want our help to share your vision, or more established and want to understand the benefits from becoming a corporate member, contact us at [email protected]. And to find out who we know and what we know, download our parametric insurance report.

Find out what you’ve missed…

Issue 8 – Smart parametric insurance contracts

Issue 7 – Parametric protection against drought risk

Issue 6 – Covering intangible assets with parametric

Sign up to the Parametric Post to receive the latest news, stories and insights on parametric insurance every two weeks.